The benefits of mediation, arbitration and alternative dispute resolution derive from their

versatility and independence from court

versatility and independence from court

bureaucracy. The general concept of ADR has

gained wide support among legislatures and

courts. Successful ADR programs ensure

neutrality, provide a forum for mutual education

and encourage the parties themselves, not just

their lawyers, to join in the negotiating process. In

some instances, ADR may afford quicker resolutions and lower costs than conventional court proceedings.

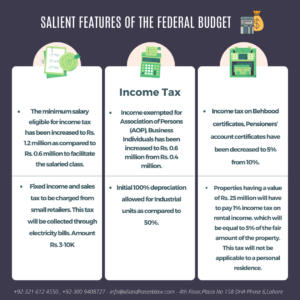

million to facilitate the salaried class.

million to facilitate the salaried class. with the complexities of Pakistan’s

with the complexities of Pakistan’s  while indirect

while indirect  Income

Income