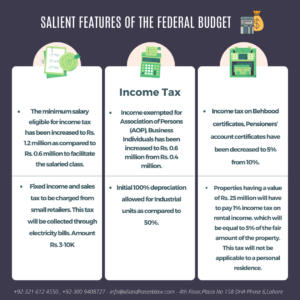

The minimum salary eligible for income tax has been increased to Rs. 1.2 million as compared to

Rs. 0.6

million to facilitate the salaried class.

million to facilitate the salaried class.Income exempted for Association of Persons

(AOP), Business Individuals has been increased to

Rs. 0.6 million from Rs. 0.4 million.

Income tax on Behbood certificates, Pensioners’

account certificates have been decreased to 5%

from 10%.

Fixed income and sales tax to be charged from small retailers. This tax will be collected through

electricity bills. Amount Rs. 3-10K.

Initial 100% depreciation allowed for Industrial units as compared to 50%.

Properties having a value of Rs. 25 million will have to pay 1% income tax on rental income, which

will be equal to 5% of the fair amount of the property. This tax will not be applicable to a personal

residence.

15% capital gain tax to be charged on immovable properties sold under one-year holding period.

Advance tax for filers for property transactions has been increased to 2% from 1%. And the same

has been increased to 5% for the non-filers.